March 27, 2020, by Tamarine Cornelius

The bipartisan economic response bill that has passed the U.S. House and the Senate would provide direct payments to Wisconsin residents, with the dual goals of helping people afford basic needs and stimulating the economy. The additional cash would be a welcome relief for families that are out of work or struggling to get by, but the provision delivers aid slowly to some, and blocks some immigrants from getting any aid at all. The bill now goes to President Trump for his signature.

In addition to providing assistance for businesses and local governments, the stimulus bill provides a payment of $1,200 each to most adults, with an additional $500 payment for each child age 16 and under. The payments phase out at higher incomes, starting at $75,000 for a single adult, $112,500 for a single parent, or $150,000 for a married couple. For people who already have bank information on file with the IRS, the money will be deposited electronically. Others will get paper checks in the mail.

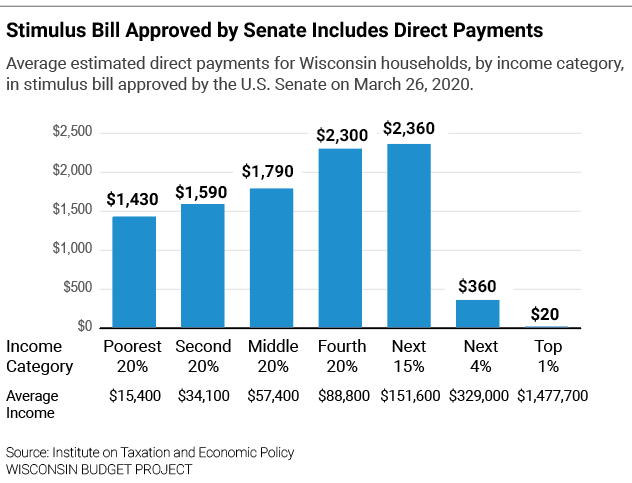

For Wisconsin households, direct payments for most households would range from an average of between $1,400 and $2,400, depending on the income category, as shown in the chart. Households with lower incomes would have lower payments in part because they are more likely to have one adult in the household rather than two. Households in the top 5% by income would get little in the way of direct payments due to the income phase-out.

For the most part, the direct payments are designed in a way to get desperately-needed aid delivered quickly to families with low and moderate incomes. People don’t need to apply to get the credit: The IRS will send the money automatically, using information on 2018 or 2019 tax returns to assess income eligibility.

The bill does have some shortcomings, including that it delivers aid to people more slowly if they didn’t file income taxes in 2018 or 2019. Not everyone is required to file a federal tax return, particularly people with low incomes. People who did not file for 2018 or 2019 may have to file a tax return in order to receive the checks, unless they receive Social Security or disability payments, in which case the federal government already has enough information to process a check. Filing a tax return right now may be challenging, since many services that help low-income taxpayers file taxes have suspended in-person operations to help slow the spread of the coronavirus.

The other major shortcoming is that the bill excludes some immigrant workers from receiving direct payments, despite the fact that immigrant communities are an important part of our economy and should be included in measures aimed at addressing the slowdown. The stimulus bill bars immigrants who can’t get Social Security numbers from receiving the direct payments, even if they have filed federal tax returns. In fact, if anyone in the family can’t get a Social Security number, such as the spouse or child, no one in the family will be able to claim the credit. In Wisconsin, there are an estimated 54,000 children in mixed-status immigrant families in which at least one family member can’t get a Social Security number, all of whom will be blocked from getting the credit.

The direct payments in the bill would provide timely financial assistance to many families. But the bill puts administrative burdens on some people with low incomes to claim the credit, and blocks families that include people who are undocumented from receiving the credit at all. As Congress considers additional aid packages, they need to make sure to give assistance to everyone who needs it, and not leave out important members of our community.